The technical indicators counsel that Bitcoin (BTC) may surpass $140,000 by the tip of 2025 regardless of the continued integration section.

The forecast is predicated on the outlook from distinguished on-line cryptocurrency analysts. Commerce shot,who, TradingView Posting on September thirtieth, I highlighted the 20-period transferring common of property (1W MA20) as an essential information to this objective.

Consultants observe that this indicator has traditionally led to a bullish continuation of Bitcoin and defines momentum now.

Since April 2025, Bitcoin has been on the uptrend with every weekly closing above the 1W MA20. This threshold, significantly within the uncommon instances the place worth motion fell beneath this threshold in June 2023, the decline continued till we examined or approached the long-term blue trendline, the 1W MA50.

Latest market conduct has strengthened this stage of significance. Since August twenty fifth, Bitcoin has closed for per week past the 1W MA20, solidifying its position as assist. This affirmation will improve increased priced instances so long as the degrees proceed to be retained.

Traditionally, when Bitcoin bounces off this construction, the rally has exceeded 90%. Even the weakest advances within the present cycle reached 96.38%. The same transfer from the present setup forecasts an upside goal of round $145,000 by December.

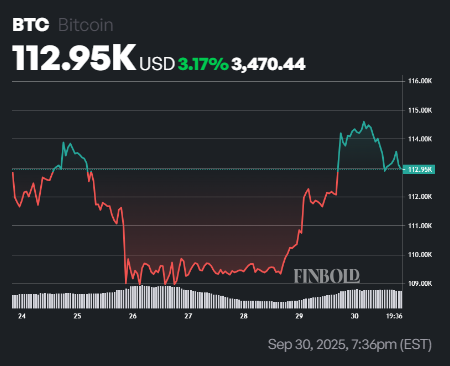

Bitcoin worth evaluation

On the time of urgent, Bitcoin was buying and selling at $113,000, barely correcting 0.7% within the final 24 hours, incomes virtually 3% previously week.

Presently, Bitcoin is slightly below $113,849 for the 50-day SMA, but it surely maintains a robust lead at $104,380 for the 200-day SMA.

This setup displays a wholesome long-term uptrend as it’s a key indicator of sustained bullish momentum as its costs are nicely above the 200-day common.

Nevertheless, a small buying and selling in a 50-day SMA suggests short-term consolidation relatively than quick breakout depth.

In the meantime, the 14-day RSI at 52.51 has a impartial stance, with the acquisition not being oversold and exhibiting balanced momentum.

Featured Pictures by way of ShutterStock