It is a phase of the Ahead Steering E-newsletter. Subscribe to learn the complete version.

Dozens of public firms presently maintain Bitcoin on their steadiness sheets, however the world of the world – sure, Hundreds – Extra comply with fits are inevitable. Not less than in keeping with panelists at Bitwise's Bitcoin Normal Firms Investor Day.

“For everybody carrying an orange tie…it's good to be on the crew with you,” technique founder Michael Saylor informed the gang on the occasion Thursday.

He then wished to decrease the tint of the home windows on the pier 59 to forestall him from observing the PowerPoint presentation. They started to descend after some time, as if the Bitcoin gods had heard him.

It's the everyday spill of Saylor and you might have heard of it earlier than. Most asset lessons don’t beat monetary inflation. Bitcoin permits Nigerian Uber drivers to outperform New York's smartest cash managers. It's a greater model of the gold he expects to hit $13 million in cash by 2045. It's not good.

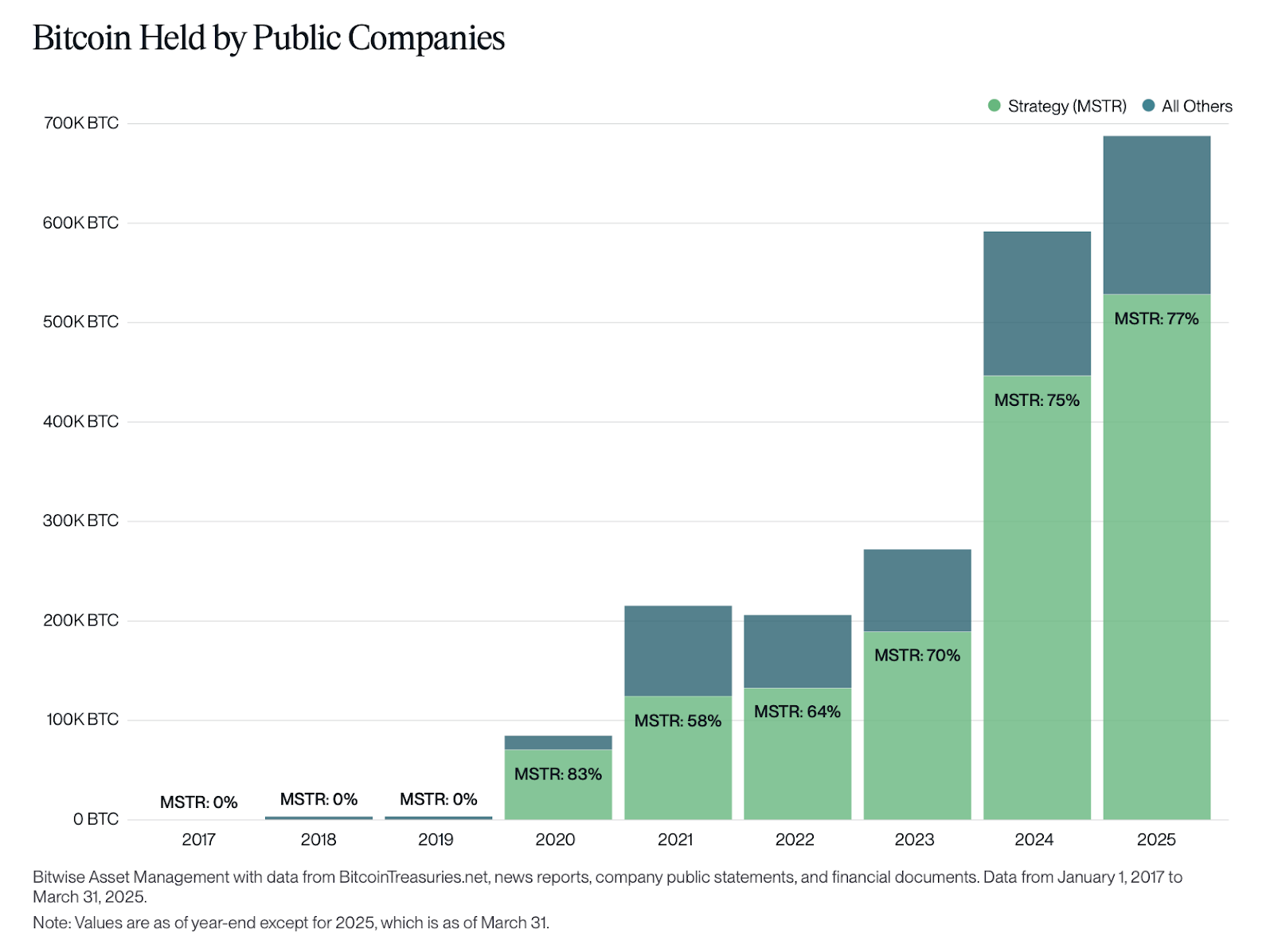

The technique owns 538,200 BTC. (In brief, how do they plan to proceed shopping for?)

“I'm not bragging about this as a result of the reality was how we did it,” Saylor mentioned. “All the pieces that each one these firms do may be very sophisticated. We couldn't create Nvidia chips or create iPhones. You’ll be able to copy me.”

However what about them?

In its first quarter report, Bitise will place the variety of public firms holding BTC at 79.

Kraken CFO Stephanie Lemmerman made maybe essentially the most attention-grabbing prediction. She expects that round 20% of the roughly 55,000 public firms will personal BTC in a couple of years from now.

that's proper quite a bit of an organization. Like 11,000.

An essential a part of the imprecise “wideer adoption” narrative you're listening to quite a bit, permitting firms diving in to maneuver costs whereas providing extra assist.

Eric Semler of Semler Scientific Chair identified how the medical expertise suppliers sit in a wealth of money and face challenges inside their core enterprise. The corporate first bought BTC final 12 months and presently owns 3,303 BTC.

It took an previous SEC month to approve Semler's first market market (ATM) providing, nevertheless it helped them purchase extra Bitcoin, says Semler, the new-looking agent rapidly sparkled inexperienced.

He added that there are most likely 1000’s of “' in what they known as “zombie” firms in comparable circumstances that may profit from the BTC monetary technique.

After which there are individuals who wish to develop larger. The brand new Tether and SoftBank-backed entity paired with Twenty One Capital – Cantor Fairness Companions seems to be launching at round 42,000 BTC. It’s behind technique and Bitcoin Minor Marathon Digital solely.

“There are plenty of small … Bitcoin finance firms. They play a task,” mentioned Robert Harrington of Cantor Fitzgerald. “However I believe this market wants scale.”

Extra firms will comply with as one of many seven epic firms start buying BTC, panelists famous all through the day. You could keep in mind that Microsoft shareholders rejected the associated proposal in December.

In fact, we all know that Bitcoin is unstable. The viewers requested what would occur if the worth of the BTC fell beneath the worth the corporate received.

You will need to set up a “board adjustment” that this can be a long-term play, mentioned Hayley Lennon of Fold Normal Counsel. She added: “Until the fundamentals of Bitcoin change, the objective is to not promote.”

Lemmerman mentioned, “It's not essentially the place you went, it's the place you count on (BTC) and what you are expecting.”

Fundstrat Capital Cio Tom Lee additionally argued that “there may be much more to the (Bitcoin) Treasury story” than shopping for considerable speculative property. It is a sort of new accounting commonplace. “The thought is that money holdings will not be required solely in US {dollars}.”