Through the years, crypto tasks have typically launched tokens within the identify of governance or community safety. On this mannequin, token holders have the correct to vote on proposals and information the way forward for the undertaking within the spirit of decentralization.

However in lots of instances, these tokens do little that’s significant to the worth of the undertaking. And the concept of issuing cryptocurrencies in 2025 might be outdated. It’s clear from latest market exercise that tokens require some form of utility and buyback/burn technique to create worth.

Flaws within the spirit of decentralization

Numerous blockchain tasks have launched tokens, even when having a cryptocurrency was not essentially central to their focus.

There may be actually an underlying enterprise purpose for this. This consists of the truth that tokens can have vital upward worth when first listed on an change.

Good query, the outdated mannequin of needing tokens to safe the community has been changed by the right use of tokens as a quasi-equity/reward hybrid car to develop viewers and income. $BNB led the best way. $HYPE and $PUMP have improved upon it. Everybody might be doing it quickly. https://t.co/wmUT1geBmk

— Jeff Dorman (@jdorman81) September 19, 2025

Many tasks are launching tokens within the spirit of a noble effort to strengthen decentralization or give voice to communities associated to decentralization, i.e. to extend distribution and participation.

Nevertheless, this will additionally result in group quagmire. One latest instance of this comes from the Throughout protocol. Danger Lab, an affiliate of the undertaking, reportedly manipulated the DAO's governance to acquire $23 million in tokens to fund its future operations.

Danger Labs CEO Hart Lambur refuted the manipulation claims in a colorfully titled Twitter/X article, claiming the accusations had been motivated by rivals.

TLDR: The Throughout Protocol/Bridge ($ACX) crew used secret voting to extract as much as $23 million from the Throughout DAO's treasury to learn a personal firm.

Background: I've posted many occasions about “in identify” DAOs, or “organizations that fake to be run by…”

— Ogle | glue.web (@cryptogle) June 26, 2025

No matter who is correct or unsuitable on this matter, this in all probability highlights the truth that the DAO mannequin could also be outdated.

Is Pioneer BNB?

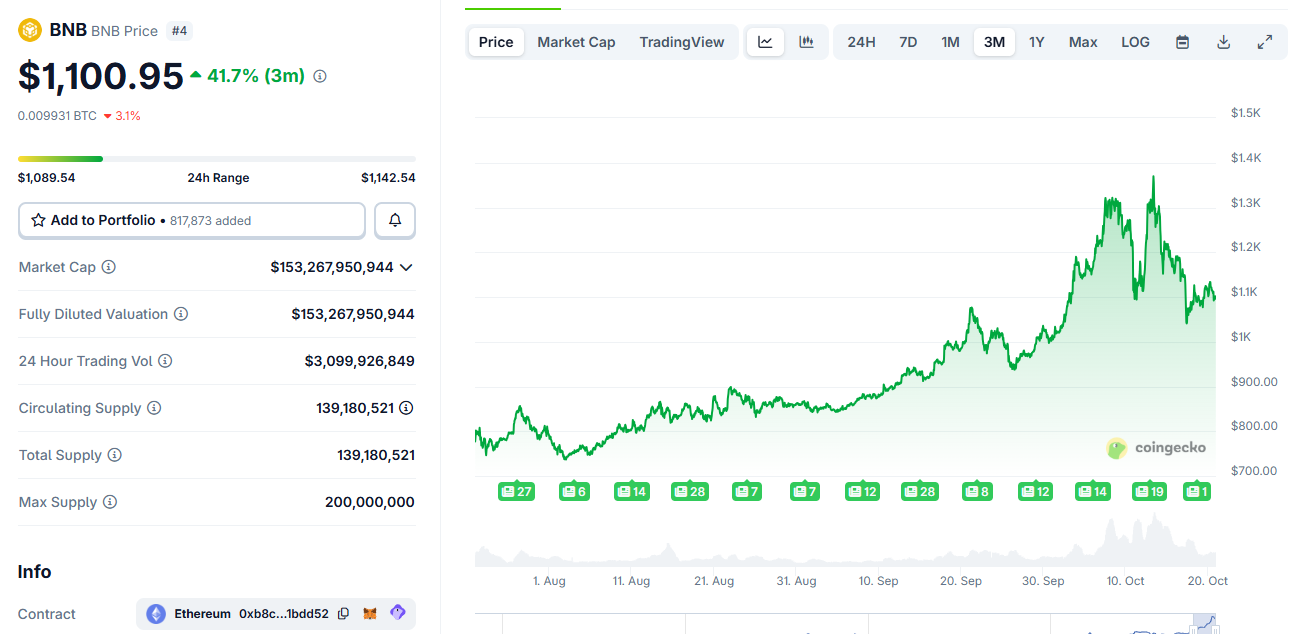

Regardless of many controversies, Binance's BNB stands out as a mannequin of utility.

Initially known as Binance Coin and launched in 2017 on the top of the Ethereum ICO period, BNB was initially an Ethereum ERC-20 token.

In 2019, BNB was migrated to the Binance Good Chain platform.

BNB builders initially had practicality in thoughts. That's why it carried out otherwise than most cryptocurrencies and was an outlier when it launched in 2017.

From giving change customers a 25% low cost on buying and selling charges on Binance to changing small quantities of non-tradable cryptocurrencies into BNB, this token is in real-world use in its personal ecosystem.

BNB value historical past since launch. It reached $1,000 for the primary time on September twentieth. supply: CoinGecko

Binance burns BNB primarily based on the buying and selling quantity of the change. In response to BNBBurn.information, greater than 62 million BNBs had been burned out of the unique 202 million in circulation, lowering the general provide by 31%.

Utility and burn seemingly pushed the BNB token value to an all-time excessive, reaching $1,000 in September.

HYPE and PUMP comply with the BNB mannequin

There are different crypto tasks which might be clearly taking discover of BNB's success.

Hyperliquid is a perpetual spot decentralized change constructed on a proprietary blockchain and an EVM-compliant good contract system known as HyperEVM, which additionally burns tokens.

HYPE cryptocurrency is the one technique to pay platform charges and is mechanically burned.

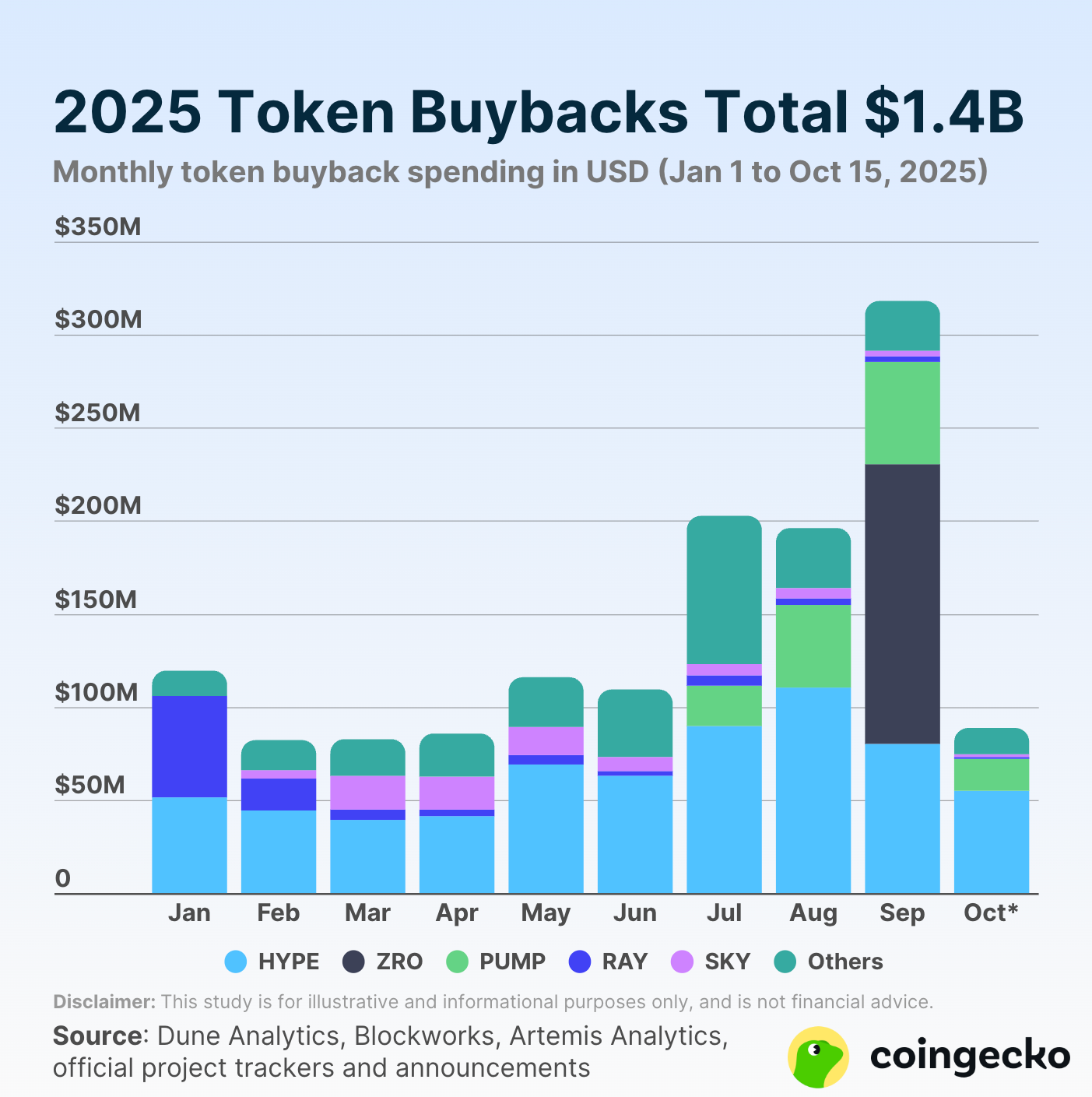

Main token buybacks in 2025. Supply: CoinGecko

Though Hyperliquid faces competitors from the likes of Binance-backed Aster DEX, its token continues to carry out effectively, rising greater than 500% since its launch.

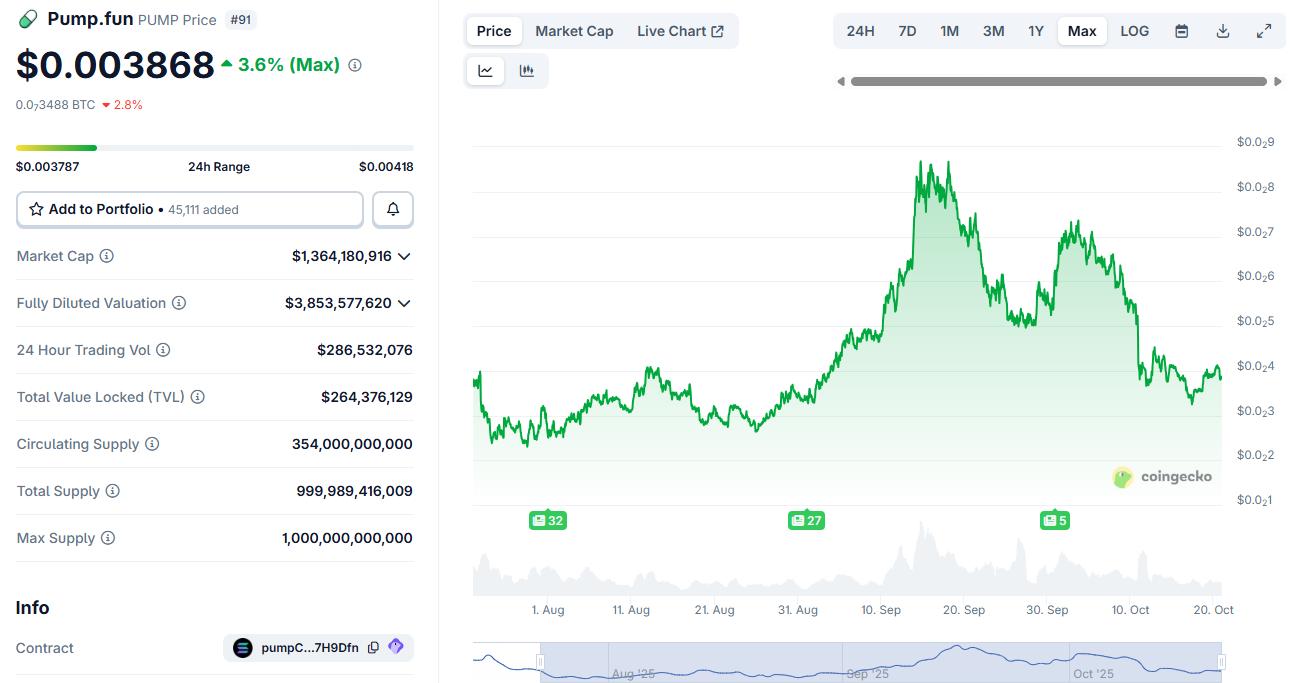

Memecoin launchpad Pump.enjoyable, which raised $500 million in an ICO over the summer time, is one other instance of share buybacks which have had an influence on the undertaking.

PUMP has endured promoting stress since its ICO, seemingly because of buybacks. sauce: CoinGecko

Pump.enjoyable has made enormous income within the cryptocurrency area, producing over $800 million in charges from merchants FOMOing varied meme cash on the platform.

Pump additionally buys again tokens. Since its launch in July, it has already bought over $114 million in cryptocurrencies.

Promoting stress on account of the ICO could have introduced the value of the PUMP token to the same degree as at launch.

Nevertheless, this token has solely been obtainable on exchanges since July. It might be too early to attract conclusions about PUMP's quick efficiency.

future token

Tokens have to be really used throughout the ecosystem, and lowering provide within the type of buybacks/burns general will cut back promoting stress.

Tasks like BNB, HYPE, and PUMP are clear use instances for tasks and buyers to bear in mind going ahead.

Wall Road's curiosity within the cryptocurrency market is rising. And token efficiency, like inventory costs in conventional finance, is a real measure of the deserves of many blockchain tasks.

As new tokens reminiscent of MetaMask, Base, and many others. enter the market, the group surrounding them should advocate for utility and buyback/burn fashions to make sure each sustainability and long-term efficiency.

This text “Why token buybacks are one of the best measure of a crypto undertaking’s success” was first printed on BeInCrypto.