Inflation anticipated in Venezuela in 2025 and the collapse of the bolivar in opposition to the greenback are forcing Venezuelans to undertake parallel options to guard their buying energy. Stablecoin Tether (USDT) and fintech software Cashea stand out as a part of the anti-inflation measures utilized by Venezuelans.

These two mechanisms have gotten built-in as a method of financing and safety in opposition to monetary deterioration.

This yr to date, Venezuela's official greenback rose 290%. This made the minimal wage for staff equal to 65 cents on the greenback. The so-called “bonus” will increase the typical Venezuelan's revenue by simply over $100.

Moreover, inflation continues to rise. Within the absence of official information from the Central Financial institution of Venezuela (BCV), whose final report was launched in November 2024, different organizations are making their very own predictions, as is the case with the now-defunct Venezuelan Monetary Supervisory Authority (OVF).

OVF analysts famous that of their newest report launched in April 2025, the inflation price ended at 18.4% month-on-month. Annualized enhance of 172%.

Furthermore, the Worldwide Financial Fund (IMF) predicts that inflation will rise to 269.9% this yr and finish at 682% in 2026. Analysts on the Institute of Financial and Social Research (IIES) at Andres Bello Catholic College (UCAB) predict that the inflation spiral will attain 220% by the tip of 2025.

The next graph reveals the evolution of annual inflation in Venezuela over the course of 1 yr. We are able to see that from January 2025 onwards, the indicator began to extend steadily till April.

US greenback money utilization decreases

This hyperinflation state of affairs just isn’t new, as Venezuela has already skilled hyperinflation in latest historical past. This case initially prompted a increase in money {dollars}. Within the midst of a moribund financial system in 2018, {dollars} began flooding into the socio-economic realm, giving the scenario some respite.

Nevertheless, the usage of bodily {dollars} within the South American nation has steadily declined since 2020. Which means within the first half of 2025, Money foreign money utilization decreased by 37% in comparison with the earlier yr, based on information from socio-economic evaluation agency EcoAnalytico.

Which means The usage of the bolivar as a method of cost as soon as once more took the lead. That is partly as a consequence of a sequence of presidency measures that impose extra taxes on greenback purchases.

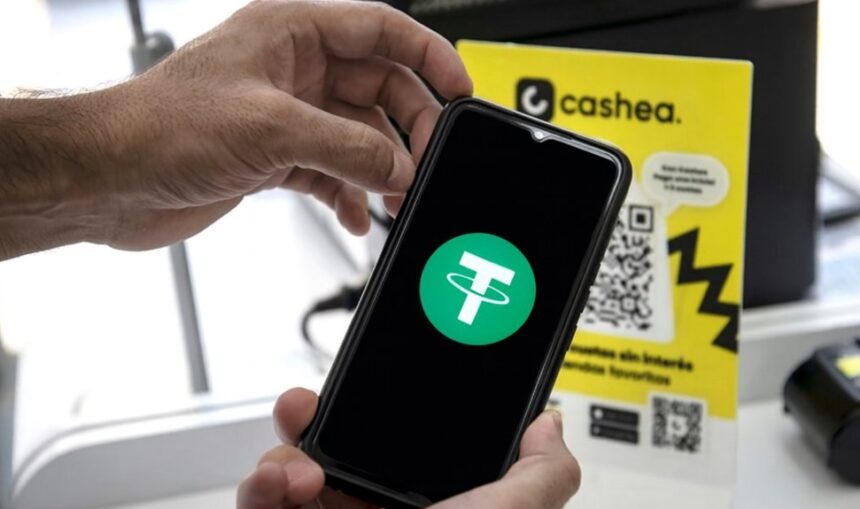

As a result of above, the market worth is linked to the US greenback, making USDT much more distinguished as a substitute for the normal US greenback. final yr Adoption of this stablecoin is growing As reported by CriptoNoticias, it was developed in Venezuela by the corporate Tether Restricted.

This may be seen in corporations which have began to combine funds on the level of sale utilizing USDT, an asset circulating in peer-to-peer (P2P) markets working at costs above 300 bolivars per unit within the nation.. That is greater than 50% larger than the official price set by BCV.

This integration was carried out organically by means of Binance and thru functions and partnerships between native corporations and their exchanges. This allowed Promote the adoption of USDT as a secure haven amid money shortages and lack of confidence in nationwide currencies.

Economist Daniel Arraez stated, “Having no bolivar foreign money and taking shelter in USDT is a legitimate possibility as a result of the actions of the bolivar foreign money out there don’t have an effect on them.”

In a remark to CriptoNoticias, the digital asset skilled clarified that USDT is “not equal to 1 greenback” as a result of it’s non-public cash issued by an organization. However, the US greenback itselfis a sovereign foreign money.

Nonetheless, he factors out that utilizing USDT in Venezuela would permit the nation to “higher climate inflation” and function in worldwide markets with much less publicity to home foreign money devaluations.

savior of belief

In parallel, Casia, Venezuela's major credit score and debt firm, launched digital credit score in an setting the place conventional banks misplaced the flexibility to finance consumption.

Primarily based on the “purchase now, pay later” mannequin, the applying processes transactions equal to three.5% of Venezuela's month-to-month gross home product (GDP) ($8.57 billion), or greater than $300 million every month.

Furthermore, its presence reaches 40% of customers who’ve entry to fintech companies in Venezuela, facilitating installment funds for merchandise, Common client finance dollarized product Funds may be made in native or steady currencies in installments.

Arraez emphasizes that the emergence of Casia will “scale back the inflationary impact” by restoring a type of credit score that nationwide banks can’t keep. By accessing dollarized digital strains, customers can cushion the lack of buying energy and stabilize spending within the face of foreign money fluctuations, he explains.

The truth is, this mannequin encourages casual arbitrage practices, with some customers shopping for items with Cashea credit and reselling them at parallel charges. This displays the pursuit of liquidity in a constrained financial system.

In line with a report from CriptoNoticias, Venezuela's procuring sector just lately underwent a revolution after Cashea introduced threat changes within the face of the foreign money disaster and the rise of USDT.

financial protection mechanism

As such, USDT and the Cashea binomial have change into an financial protection mechanism within the midst of commerce revitalization and rising inflation.

This duo is successfully anti-inflation. As a result of, on the one hand, buying energy will increase by 50% in Venezuela, which protects worth and avoids value will increase. Cashea, however, enables you to purchase on credit score with out curiosity, so you should purchase all kinds of merchandise at present costs. And we pay them with cash that has devalued when measured in bolivars because of the continued devaluation of that nation's foreign money.

Certainly, at a time when the bolivar has stalled and financial institution credit score stays restricted, stablecoins and native fintechs are They’re reimagining financial savings, funds, and digital consumption channels.

With the IMF predicting that Venezuela's inflation will progressively escalate in 2026, Monetary digitalization emerges as the one purposeful means To keep up entry to worth and credit score.

The dollarization of expertise, supported by belongings like USDT and platforms like Cashea, is thus redefining the way in which Venezuelans face crises. Whereas it definitely doesn’t change the financial stability that has been misplaced, it definitely offers a sensible various to the inflation that continues to erode buying energy. And it reveals no indicators of reversing within the quick time period.

(Tag translation) Cryptocurrency