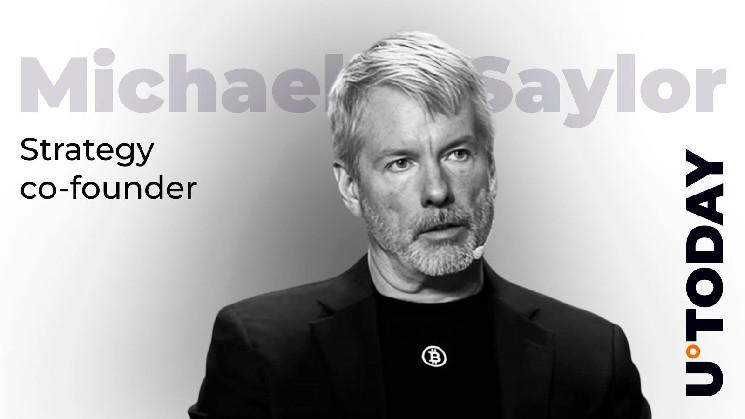

Michael Saylor, the person whose Company Treasury Division has turn out to be roughly synonymous with Bitcoin itself, says as soon as 2025 reaches its ultimate quarter, “Will BTC shut a yr past $150,000?”

His polls have already exceeded 42,000 votes, and three out of three in 4 imagine that the world's largest cryptocurrency can obtain that purpose.

For Saylor, that is greater than only a random concept. Technique, an organization registered with NASDAQ, which he’s chargeable for, has 640,031 BTC bought since August 2020 for a median of $73,981. Valued at greater than $77 billion at a value of $120,700 as we speak, this stash has grown by greater than 63%.

Will $BTC finish the yr above $150,000?

– Michael Saylor (@saylor) October 3, 2025

Nevertheless, the significance of the $150,000 mark exceeds the income of paper.

As soon as Bitcoin strikes into that zone, the worth of the technique's holdings will enhance by greater than $18 billion. This brings BTC's place nearer to the $96 billion line and transforms the corporate into an asset base corresponding to a few of the world's largest banks.

A $100 Billion Technique

The market has already proven approval. Strategic shares are value round $100 billion, and their firm worth is round $115 billion.

The Bitcoin chart additionally reveals why this query is so vital. Its market capitalization is simply $120,000, and BTC is rising from its low level in September, approaching its summer time excessive.

The ultimate three months of 2025 present whether or not Saylor's bets have was one of many greatest company victories of the last decade or whether or not it has turn out to be probably the most troublesome bubble burst of this century.