A latest Cambridge report confirms that the US is at present main world Bitcoin mining, prompting questions on how China will reply. Whereas the nation has lengthy maintained an anti-cryptic stance, China's mining swimming pools have traditionally managed a good portion of the world's Bitcoin hashrate.

The brand new hostility in the direction of the US's present competitiveness and commerce coverage might be motivated by China to copy it. Beincrypto spoke with representatives from the Coin Bureau and Wanchain to know what may doubtlessly encourage China to vary its stance on digital property.

The US overtakes China as the highest Bitcoin mining hub

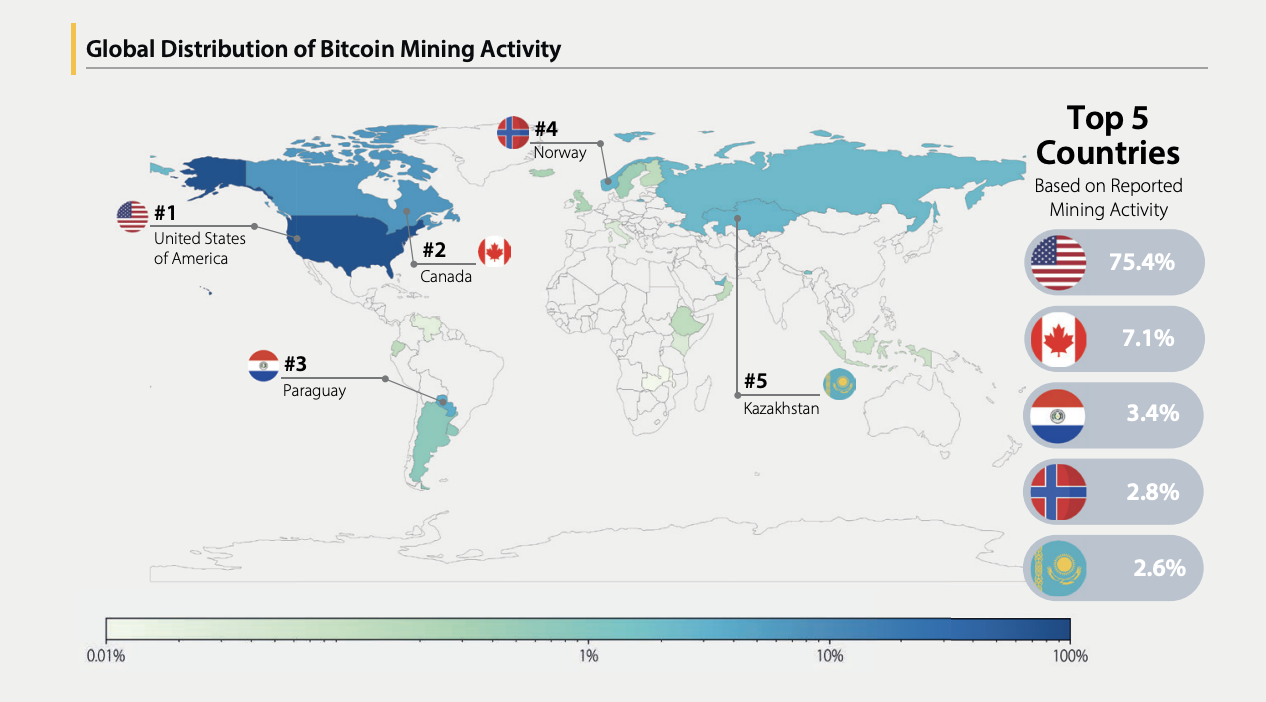

America has established itself because the world's largest Bitcoin mining hub. A latest Cambridge Heart for Different Finance (CCAF) report revealed that the US accounts for 75.4% of reported hashrates.

International distribution of Bitcoin mining actions. Supply: CCAF.

This newest improvement confirms a reversal of the outstanding energy over the benefits of Bitcoin mining. China emerged because the world's main Bitcoin mining nation in 2017, leveraging its intensive mining infrastructure and low energy prices to donate greater than 75% of the world's hashrate at one level.

However the nation will later crack down on the trade.

Chinese language Cryptocurrency

In 2019, the China Nationwide Growth and Reform Fee (NDRC) expressed its intention to ban cryptocurrency mining by releasing a invoice that it classifies as an “undesirable trade.”

Two years later, no less than 4 Chinese language provinces started halting mining operations. These crackdowns have been strengthened amid issues over extreme vitality consumption.

In the direction of the top of 2021, the federal government has declared all crypto-related transactions unlawful, additional strengthened the ban and banned overseas exchanges from serving Chinese language residents.

Nevertheless, China has the confirmed capability to adapt to geopolitical modifications that might put its financial management in danger, and the present surroundings could pose such challenges.

Has Bitcoin mining in China actually stopped?

Regardless of China's official stance on Crypto, mining actions haven’t halted throughout the area. In July 2024, Bitcoin's environmental impression analyst Daniel Batten reported that the hashrate inside China at present accounts for round 15% of the worldwide whole.

“Despite the official ban, the infrastructure is already in place. From offshore mining to cross-border commerce hubs. With the extra world momentum behind crypto adoption and taking lead, China might be incentivized to lean extra strategically, even when it's out of labor.”

China additionally has geographical benefits over the US, notably relating to technological developments.

Cryptomization, particularly for cryptocurrencies for work proofs like Bitcoin, depends on application-specific built-in circuits (ASIC) tools to deal with the advanced calculations required for verification and mining.

Crypto Mining {Hardware}, notably China's place as a prime exporter to the US, provides potential advantages if it decides to revive the mining sector.

The event of tariff disputes between the 2 nations provides a layer of uncertainty to the long-term cost-efficiency of US mining operations.

Puckrin believes that the mix of commerce friction and a vibrant push for US crypto dominance could also be enough to assist China rethink its place.

“It’s unlikely that China will publicly disclose its ban on crypto mining and buying and selling anytime quickly. Nevertheless, as US-based miners contemplate the next proportion of Bitcoin's hashrate, it’s possible that China goes to quietly reassess that stance,” Puckrin informed Beincrypto.

Nevertheless, China has a method apart from reopening Bitcoin mining to undermine US management.

China's refined method past us will have an effect on us

Though China opposes the widespread use of cryptocurrencies inside its dwelling, digital property should still be price it to offset the US greenback's world forex management.

A number of nations around the globe are contemplating adopting or contemplating central financial institution digital forex (CBDC) to strengthen their nationwide currencies. China is on the forefront of those developments.

“Despite the ban on Bitcoin mining, China has actively participated within the digital property sector by way of initiatives akin to CDBC Analysis, Digital Yuan, or E-CNY,” Wanchain CEO Temujin Louie informed Beincrypto.

Actually, China's efforts to create digital yuans are pushed partly by a need to deco-orient its financial system and scale back its dependence on the US greenback.

Louie additionally urged that it doesn’t matter what transfer China brings, it isn’t simply the idea for its choice based mostly on what the US is doing or not.

“As regular, in China, a refined method is greatest. Coverage modifications usually are not attributable to US tariffs. Relatively, China's selections are knowledgeable by world market developments and China's personal home technique,” added Louis.

That stated, China's selections relating to digital forex will have an effect on how its place on crypto continues to develop.

“Whether or not exacerbated or brought on by President Trump's method to tariffs, weakening USD management may doubtlessly make China extra aggressive in its efforts to internationalize the yuan, together with the digital yuan.

China's actions in different areas of worldwide commerce have already confirmed how modifications in its coverage can turn out to be nuanced.

Might China's conflicting crypto coverage point out change?

Apart from the valuation of digital currencies like e-cny, China's stance on Crypto has already confirmed considerably contradictory. These contradictions could encourage the assumption that the state could also be keen to repeat, or no less than soften, banning, hole mining.

A month in the past, funding agency Vaneck confirmed that China and Russia (two nations particularly coated by US sanctions) are reportedly utilizing Bitcoin to resolve a few of their vitality transactions.

“Because the US greenback is more and more getting used as a political lever, different nations are actively investigating options, particularly within the tariff financial system. Actually, many nations around the globe, together with China and Russia, are already utilizing Bitcoin as an alternative choice to commodity and vitality buying and selling.

Puckrin's evaluation of those metrics reveals that China's “Shadow Crypto Economic system” is projected to increase this yr, which may lead to a reassertment of its energy. This revival is primarily a response to decooperative work, not primarily to the response to US domination in mining.

This exercise is more likely to improve within the close to future, particularly as extra nations use crypto to bypass the system of controlling the greenback,” he concluded.

You will need to interpret Chinese language intent, notably cryptocurrency, by observing its actions, somewhat than relying solely on official statements.