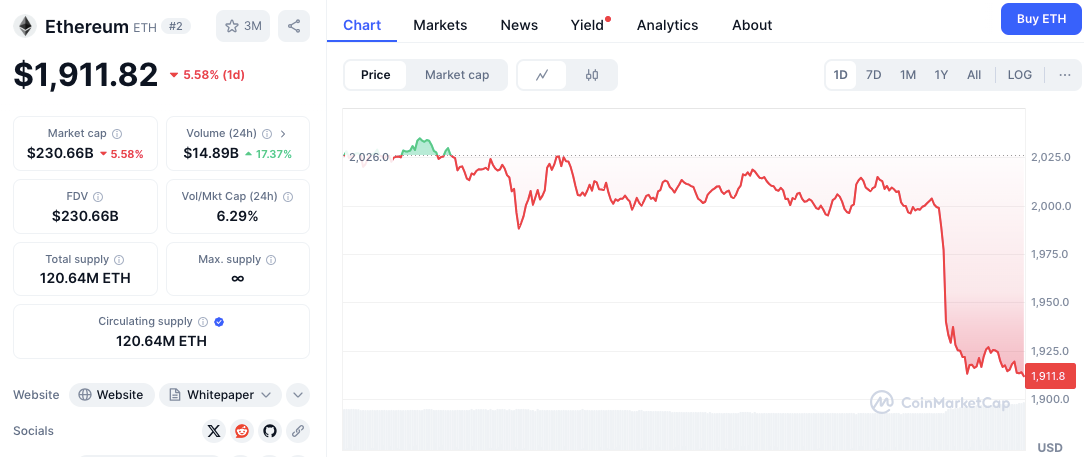

Ethereum (Eth) noticed a pointy value drop that shook traders' belief after relative stability. Cryptocurrency is presently buying and selling at round $1,917, over 5% within the final 24 hours, in keeping with knowledge from CoinmarketCap. The transfer suggests a possible breakdown from earlier horizontal buying and selling ranges, sparking new debate about Ethereum's short-term path.

The place did Ethereum discover help after drop?

Ethereum costs are presently testing fast help inside the $1,900-$1,910 vary. Early chart indicators counsel that this space could present short-term cushioning for additional gross sales pressures.

If this degree can’t be held convincingly, the following potential technical help zone will probably be between $1,875 and $1,880, primarily based on historic value motion close by. A break under that would open the door to check necessary psychological ranges round $1,800.

What resistance ranges ought to I regain to get better for restoration?

For potential restoration makes an attempt, Ethereum faces fast resistance close to the $1,950-1,960 zone. The world will function help earlier than the current sale and can probably be a hurdle alongside the best way.

Supply: CoinMarketCap

Associated: Will Ethereum lose the sting of deflation as ETH Burns disappear?

Greater than that, the $2,000 mark stands out as each a major psychological barrier and a degree of involvement within the earlier integration part. Further resistance is round $2,025-2,030, marking the current vital intraday highs that bullish merchants want to beat to point out stronger momentum.

Technical indicators present consideration of ETH bulls

ETH/USD Day by day Worth Chart, Supply: TradingView

Present technical indicators on the each day chart counsel a cautious, short-term outlook for ETH. At the moment, the relative power index (RSI) reads round 38.68, under the impartial 50 mark. This studying typically exhibits a normal bearish momentum.

It’s not but a basic “oversold” territory (normally under 30), however it means that sellers are presently in management. Lately, a shifting common convergence divergence (MACD) indicator has flashed bullish crossover alerts. Nevertheless, value motion has not been in a position to reply positively so far. Such divergence refers to basically weak buying strain regardless of the indicator sign.

The Ethereum Derivatives Market Exhibits Combined Alerts

In accordance with Coinglass knowledge, Ethereum's actions within the derivatives market mirror a considerably combined sentiment. The rise in whole buying and selling quantity of ETH futures (up 9.63% to $39.06 billion), however in actuality, there was a decline in open curiosity general (down 3.26% to $22.47 billion). This decline in open curiosity means that a number of leveraged positions probably closed through the value decline.

Associated: Ethereum Basis ETH Gross sales: Isn't the worth mover you thought?

Curiously, the ETH choices market noticed a rise in exercise on the similar time. Choices buying and selling quantity is sort of 30% (topped $666 million). These numerous traits could point out a rise in hedging exercise or speculative play, utilizing choices amid declining spot markets.

Disclaimer: The data contained on this article is for info and academic functions solely. This text doesn’t represent any form of monetary recommendation or recommendation. Coin Version just isn’t responsible for any losses that come up because of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.