Ethereum costs are under the important thing help degree of $1,800. Costs fell to an intraday low of $1,754 because the market continued to contemplate key help and resistance ranges.

Analysts imagine that the course of ETH costs will range relying on whether or not the consolidation continues or recedes.

Ethereum priced at $1,762 to check necessary help

Ethereum worth traits over the previous few days present a sequence of bearish candles, reflecting a 12% decline.

Value Motion bouncing off at $1,762 with S1 Pivot help. It is a crucial zone the place costs had been beforehand rebounded. Analysts emphasize that Ethereum's motion at this degree can decide the subsequent main worth shift.

Well-known analyst Crypto Normal factors out that Ethereum Value kinds the bottom at $1,800. If this help fails, the worth of High Altcoin might drop to $1,500.

For instance, if costs bounce above the extent above $2,000, the bullish pattern is anticipated to renew. This degree has been seen as a psychological degree for Ethereum merchants previously.

Supply: Crypto Normal, x

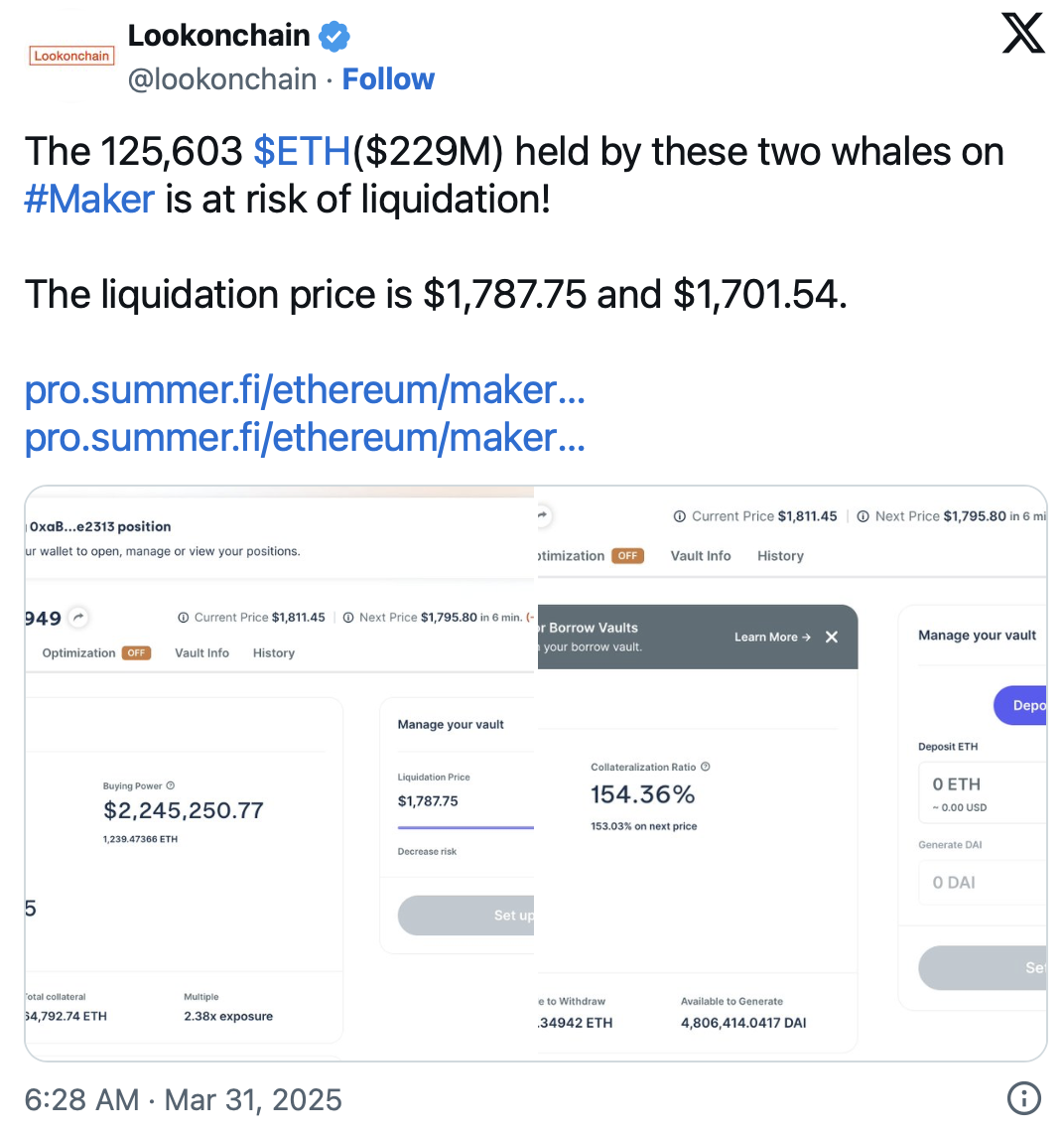

Whales face a $229 million liquidation threat

The present worth decline is now even larger than the chance of liquidation for giant Ethereum traders. Two giant whales from Makerdao maintain Ethereum close to liquidation ranges, in keeping with Lookonchain information. These whales collectively maintain 125,603 ETH, price round $229 million.

In line with Lookonchain, the liquidation worth was round $1,787 and $1,701.

Nonetheless, if Ethereum costs drop additional, liquidation might improve as gross sales strain will increase. This can additional scale back ETH costs and lengthen the continued revision section.

Ethereum's double backside reversal potential

Regardless of latest bearish traits, analysts are double-bottom patterns shaped primarily based on ETH Value's each day habits.

The double-bottom inversion sample means the tip of the bear section as the worth strikes upwards. This forecast can solely be achieved if Ethereum costs stay in positions above $1,762 and retests resistance ranges of $2,100.

Crypto analyst Jonathan Carter famous that ETH costs seem in a falling triangle.

His evaluation exhibits that if the worth exceeds the help degree, the breakout will improve the worth to $1,950, and finally will probably be $2,080. Carter saved his worth goal at $2,230 and $2,320 if the bullish momentum was strengthened.

Supply: Jonathan Carter, X

ETH worth must be regained $2,100

The $2,100 resistance degree stays an necessary barrier for Ethereum's potential restoration. If Ethereum Value can combine past this degree, it might be a contemporary buy sign.

Analysts emphasize that we have to see the double backside layer that Ethereum accumulates above this degree.

Nonetheless, if costs can’t be maintained above $1,762, the prospect of constant bearishness is looming. Because of this, if the worth falls under $1,700, the ETH worth will doubtless revisit the $1,500 degree. This shall be according to the Crypto Normal's prospects of pegging $1,500 as the subsequent main help degree if bear strain continues.