Ethereum continues to face robust resistance at $2.7k close to a essential 200-day transferring common, with latest value motion suggesting a bearish reversal.

The dearth of sustained buying momentum suggests {that a} long-term integration part, which extends to a help zone of maybe $2.2,000, is more and more possible within the medium time period.

Technical Evaluation

Every day Charts

The ETH is under the essential 200-day transferring common at present positioned across the $2.7,000 mark. This stage has persistently served as a ceiling over the previous few weeks, indicating a strong zone of gross sales strain and hesitation amongst consumers. Not regaining this key threshold led to indicators of weak point as costs started to type a spread of distribution and commenced to recommend potential corrective actions.

Given the dearth of robust bullish momentum, it seems that upcoming classes will possible regularly lower for $22,000 in help. This zone serves as a requirement pocket and presents the market a chance to reset earlier than trying one other breakout that exceeds the $2.7k barrier. Nonetheless, if the vendor positive aspects additional management, Ethereum may even retest the 100-day MA to almost 2K as the subsequent line of protection.

4-hour chart

Within the decrease time-frame, Ethereum trades inside an upward wedge formation, often a bearish reversal sample, indicating it has waned purchaser power and elevated the chance of downward failures. This construction aligns with the seen divergence of the bearishness of the RSI indicator, reinforcing the view that distribution is ongoing close to present resistance.

A breakdown under the decrease restrict of the wedge (at present round $2.4,44,000) may open the door in direction of the $2.2,000 zone. Conversely, if Ethereum unexpectedly breaks above the cap, a fast quick aperture may very well be deployed, driving costs to larger ranges of resistance with sharp restoration actions.

On-Chain Evaluation

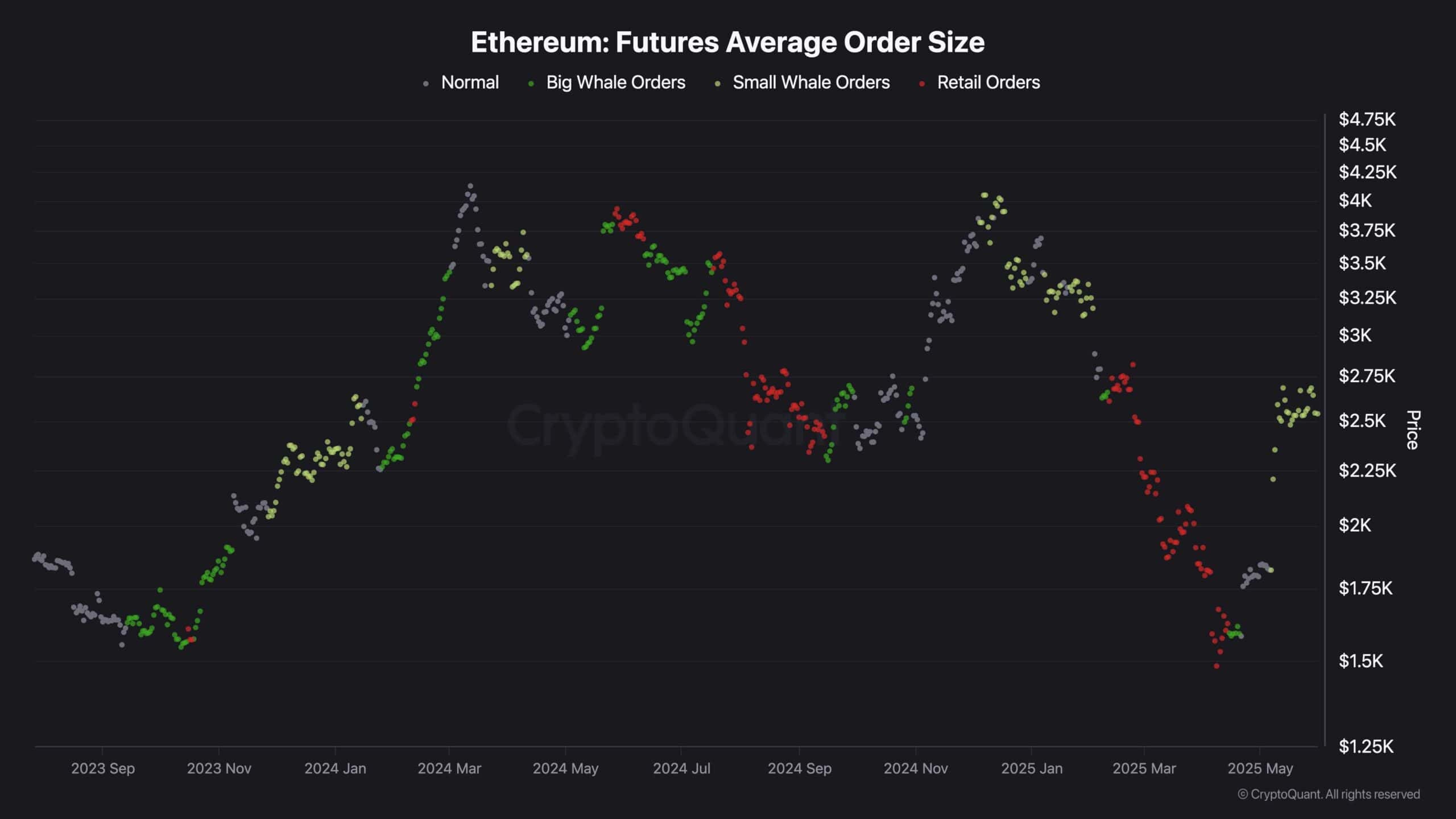

Ethereum costs proceed to fluctuate just under the important thing resistance zone, leaving merchants unsure concerning the motion of the property' subsequent essential route. One useful indicator on this context is the common order measurement of transactions executed, revealing the scale of exercise from completely different market individuals.

This surge in indicators typically signifies a rise in participation from whale buyers. Traditionally, bigger order sizes have coincided with main native tops, as whales have a tendency to have interaction in strategic revenue acquisition or elevated value ranges.

Now, the metric has climbed prominently, rising whale exercise inside the $2.5,000-2.8k resistance band. This sample suggests that enormous buyers could also be offloading positions or hedges, predicting potential adjustments in momentum.

Consequently, except a shocking bullish breakout, odds are actually favoring steady integration and deeper pullbacks within the mid-term, maybe in direction of a decrease stage of help. Buyers must be cautious and take a look at additional clues from each value construction and institutional motion.