Ethereum costs Buyers marvel if this can be a buy alternative or the start of a long-term decline. As a result of latest value motion, Ethereum has struggled to carry its most important assist ranges, with ETH costs at present buying and selling at $1,887. Cryptocurrency markets, together with Ethereum, face challenges as a result of macro uncertainty, regulatory issues and declining investor confidence.

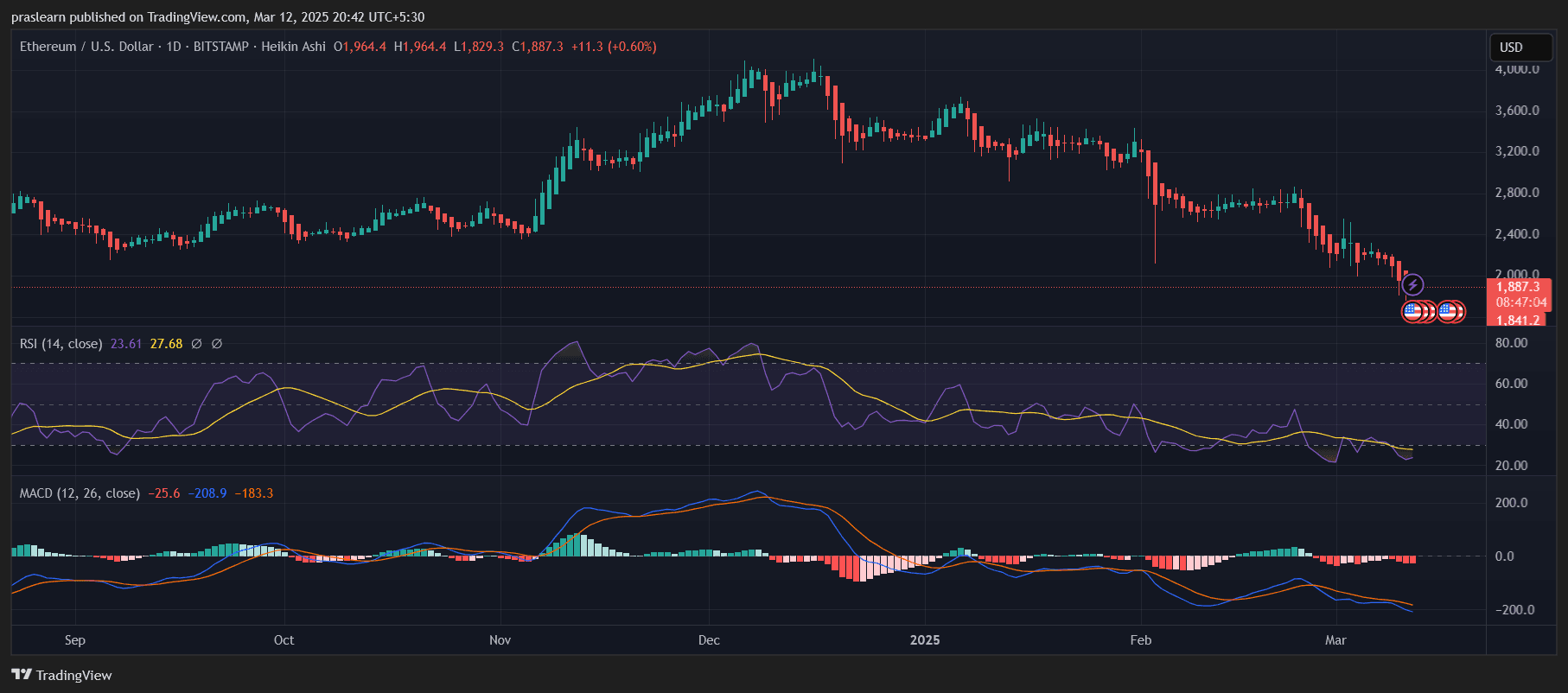

Ethereum's RSI (Relative Energy Index) of 23.61 entered excessive territory, which regularly signifies that potential bouncing could possibly be on the horizon. Nevertheless, MACD (divergence of transferring common convergence) stays deep within the destructive area, suggesting that bearish momentum remains to be managed. This raises an necessary concern. Will the Ethereum stage get a robust rebound or is it heading for extra losses?

Ethereum value forecast: Why are ETH costs falling?

eth/usd day by day charts – TradingView

The decline in Ethereum may be attributed to a number of components, together with total market sentiment, elevated competitors with various blockchains, and macroeconomic situations. The broader cryptocurrency market stoop precipitated a serious liquidation, and Ethereum was unimmunized by this development.

Ethereum fuel costs stay unstable, with some customers transferring to cheaper Layer-1 and Layer 2 options. These challenges elevate questions on whether or not Ethereum's benefit within the sensible contract ecosystem is below menace.

Regardless of these issues, Ethereum continues to have robust institutional assist, a strong developer group, and steady community upgrades. Nevertheless, value motion stays bearish within the brief time period, and Ethereum should regain a essential stage to substantiate a bullish reversal.

Ethereum Technical Evaluation: The place is ETH costs heading?

Ethereum's value motion is below robust gross sales strain. The present chart means that ETH is testing key assist zones between $1,850 and $1,800. If Ethereum can't preserve this stage, the additional draw back could possibly be pushing ETH to $1,600, and even $1,400.

The 23.61 RSI signifies that Ethereum is oversold, suggesting that bounces are anticipated quickly. Traditionally, ETH has seen a robust restoration with RSI under 30, however this isn’t a assured reversal. For a bullish comeback, Ethereum must regain $2,000 and retain it as assist.

MACD stays deep within the destructive realm, indicating that bearish momentum stays dominant. Patrons should stay cautious till Ethereum sees a bullish crossover on MACD.

If Ethereum holds $1,850 in assist and goes above $2,200, it may doubtlessly present a development reversal with a medium-term goal of $2,500-$2,700. Nevertheless, as soon as the vendor stays in management and ETH loses $1,800, it may drop even additional earlier than a restoration happens.

Ethereum Value Forecast for 2025: Will ETH attain new highs?

Ethereum stays a long-term powerhouse in blockchain area, and its basis stays robust. The Ethereum Community upgrades roadmap, institutional advantages, and will increase in real-world use circumstances, making it a compelling funding. Nevertheless, the short-term technical outlook stays unsure.

In a bearish state of affairs, Ethereum may make a deeper repair and examined $1,600-1,400 earlier than discovering essential assist. As soon as the crypto market enters the long-term bear stage, ETH could wrestle to regain momentum within the brief time period.

In a bullish state of affairs, if ETH costs regain $2,500 and break the important thing resistance at $3,000, they might regain the upward development in 2025, pushing from $4,000 to $5,000. Key catalysts similar to facility adoption, ETF approval, or elevated Defi exercise may drive robust rallying for Ethereum.

Are you shopping for Ethereum now?

ETH costs are at present at a key resolution level, and the subsequent transfer will decide whether or not it can recuperate or proceed the subtrend. The long-term foundations stay bullish, however short-term pricing measures recommend that Ethereum remains to be below strain.

For traders in search of short-term income, ready for a affirmation of over $2,200 is a safer technique. Nevertheless, for long-term holders, these ranges of Ethereum current alternatives for strong accumulation given the historic developments that can recuperate strongly after main revisions.

The longer term for Ethereum stays vivid, however within the brief time period, merchants might want to watch key assist ranges and technical metrics earlier than making choices. If ETH can recuperate greater than $1,850 and greater than $2,200, then the rally to the brand new excessive in 2025 stays a robust chance.