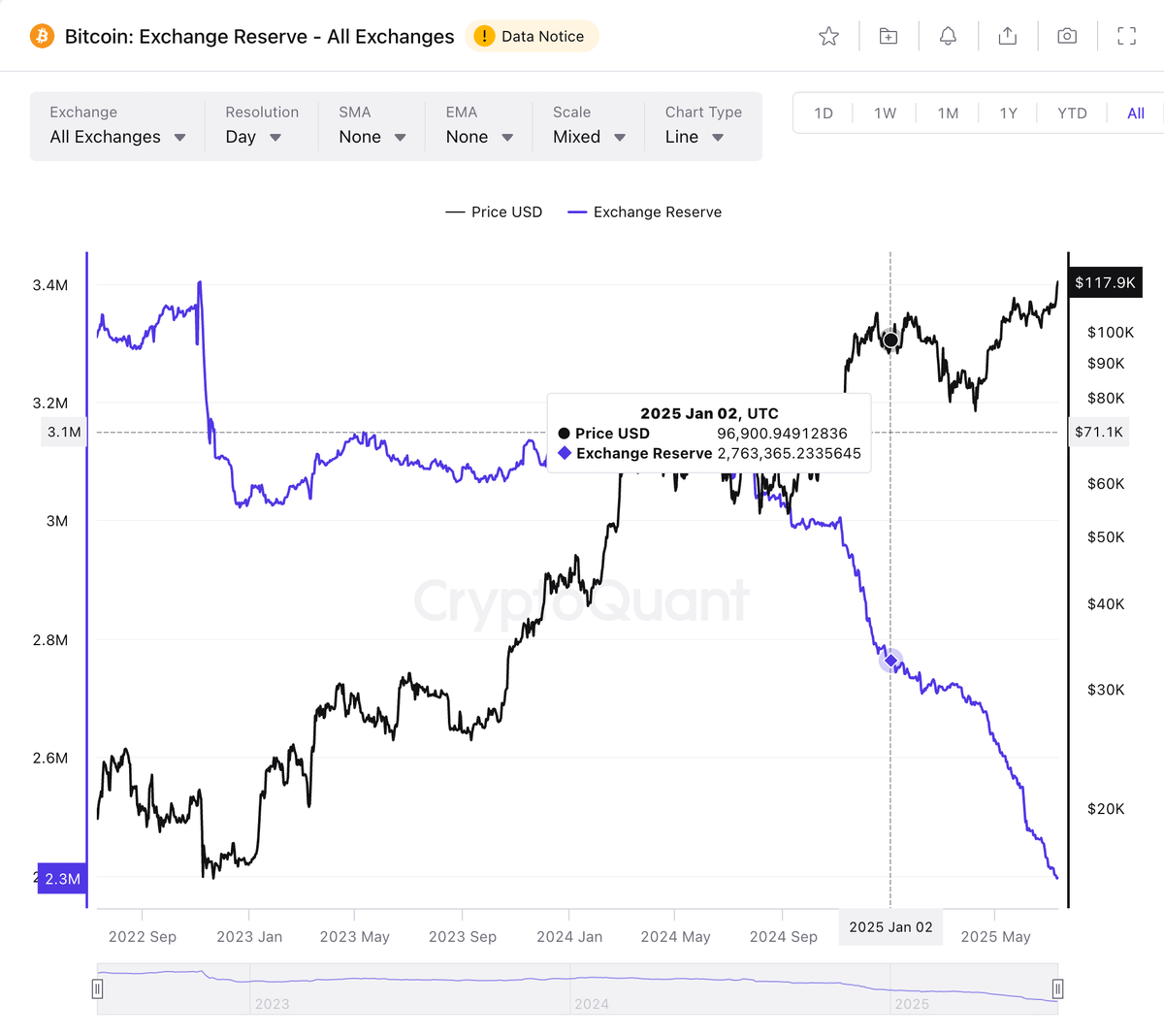

Based on new information from Cryptoquant, buyers are steadily pulling Bitcoin Holdings from centralized exchanges, with over 360,000 BTC bookings since January 2025.

This pattern reveals a serious shift in direction of independence and long-term retention of buyers as they gained momentum after Bitcoin value exceeded $96,900 earlier this 12 months.

Will retail participation in exchanges lower?

The decline in Bitcoin on the Central Change (CEXS) displays a big change in investor habits within the first half of 2025. Based mostly on evaluation by on-chain researcher @AI_9684XTPA, the reserve discount is above 360,000 BTC. At present values, that is value round $42.8 billion.

Associated: Company Bitcoin Holdings will skyrocket to $85 billion. Are you selling development?

This decline got here alongside the worth rise of Bitcoin, which reached $96,900 on January 2, 2025.

Particularly, buyers imply transferring belongings off the alternate, however typically means storage to be used on long-term or distributed finance (DEFI) platforms. As of this reporting time, Bitcoin is at the moment buying and selling at a brand new all-time excessive of 118,255, a rise of 6.4% over the previous day.

Chart information confirms ongoing tendencies

Cryptoquant visible information confirms that alternate reserves have been steadily reducing because the second half of 2024. This determine is at the moment reaching multi-year lows, ranging from round 34 million btc in 2023. This long-term downward pattern means that extra customers prioritize self-supporting over centralized storage options.

The chart additionally reveals that Bitcoin costs proceed to rise whereas reserves are falling. This divergence helps the idea {that a} decline in alternate provide could contribute to bullish value momentum.

OKX backs tendencies with web influx

Regardless of the broader withdrawal pattern, OKX, one of many high 5 exchanges by BTC quantity, has reported a web influx of Bitcoin within the final 24 hours. This units it aside from different main exchanges the place BTC spills proceed to be seen.

The inflow could also be associated to the launch of OKX's BTC Alde+ product. Designed to take care of capital whereas offering curiosity returns, this product permits for versatile deposits and withdrawals. This might enchantment to customers on the lookout for a stability between income and accessibility.

Establishments' Bitcoin holdings skyrocket above 850,000 BTC

Particularly, the decline in BTC on the alternate is in step with a surge in institutional curiosity in Bitcoin. Asset managers who use spot Bitcoin ETFs and public firms are accumulating BTC at unprecedented charges.

Based on information shared by X's Kyle Chase, by mid-2025 in 2024, the variety of public firms holding Bitcoin had risen from 64 to 151. These firms at the moment collectively personal greater than 850,000 BTC, value greater than $85 billion. Technique (previously MicroStrategy) leads the pack with 580,995 BTC. Marathon Digital, Block Inc., Tesla and GameStop are amongst different well-known company holders.

This pattern underscores the function of Bitcoin as a long-term monetary asset for firms in search of strategic publicity amid in inflation and Fiat's uncertainty.

Associated: Binance customers have dropped out of $223 million tether and Bitcoin Holdings to purchase extra Etherum

In the meantime, institutional publicity through spot Bitcoin ETFs on the US record additionally rose sharply after regulatory approval in January 2024. By mid-2025, the ETF had roughly 1.43 million btc, and roughly 6.84% of its complete Bitcoin provide. BlackRock's iShares Bitcoin Belief (IBIT) controls the ETF area, exceeding 702,055 BTC.

Disclaimer: The data contained on this article is for info and academic functions solely. This text doesn’t represent any form of monetary recommendation or recommendation. Coin Version is just not responsible for any losses that come up on account of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.