Cathie Wooden's Ark Investments has filed an S-1 submitting with the U.S. Securities and Trade Fee. $ARK CoinDesk 20 Crypto ETF, Highlighted $XRP It is without doubt one of the Fund's most vital holdings.

The appliance, filed yesterday, particularly highlights the establishment's rising confidence in diversified crypto publicity past Bitcoin to belongings comparable to: $XRP.

Vital factors

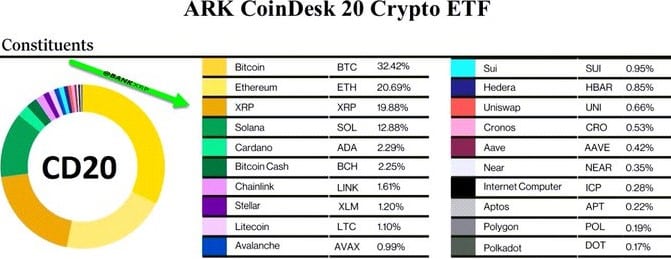

- $XRP is without doubt one of the fund's largest holdings, with a weight of 19.88%.

- It ranks behind Bitcoin (32.4%) and Ethereum (20.69%) within the whole index.

- The ETF's shares will probably be listed and traded on the NYSE Arca, Inc.

- Estimated launch funding is about $437,000, based on filings.

$XRP Roughly 20% allocation might be seen

The proposed ETF will probably be filed on January 23, 2026 and can observe the CoinDesk 20 (CD20) index. particularly, $XRP has a big weight of 19.88%, making it one of many prime parts of the fund. The token ranks solely behind Ethereum and Bitcoin, that are assigned 20.69% and 32.4% weighting respectively within the general index.

Different main cryptocurrencies within the fund embrace Solana, Cardano, Bitcoin Money, Chainlink, Stellar, Litecoin, and Avalanche, with respective weights of 12.88%, 2.29%, 2.25%, 1.61%, 1.20%, 1.10%, and 0.99%.

Ark CoinDesk 20 ETF Constituents

In the meantime, Ark Make investments will function the fund's sponsor, and CSC Delaware Belief will act as trustee. Particularly, the Fund's shares will probably be listed and traded on the NYSE Arca, Inc. The fund's nominal seed worth is at the moment $100, and beginning capital is predicted to be roughly $437,000.

what this implies $XRP

$XRPWith an allocation of practically 20%, the group is firmly within the highlight. Inclusion at this scale is $XRP As a liquid investable asset appropriate for regulated merchandise.

For market contributors, it will strengthen $XRPThe case for a long-term part of a professionally managed crypto asset portfolio might help deeper liquidity and broader adoption if the ETF is authorized.

$XRPElevated presence of spot ETFs as an entire

$XRPis included $ARK The CoinDesk 20 ETF builds on an already rising footprint of US-listed crypto funds. Over the previous 12 months, the token has been a core part of a number of main basket ETFs, together with the Bitwise 10 Crypto Index Fund (BITW), the Grayscale Coindesk Crypto 5 ETF (GDLC), and the Hashdex Nasdaq Crypto Index US ETF (NCIQ).

Past various merchandise, $XRP It’s also attracting consideration by way of single-asset spot ETFs. At present 5 $XRP Spot ETFs are traded on US exchanges and are supplied by Grayscale, Franklin, Bitwise, Canary, and 21Shares.

Since Canary launched the primary of those in November, the group has had internet inflows of $1.23 billion, bringing whole belongings below administration to roughly $1.36 billion.