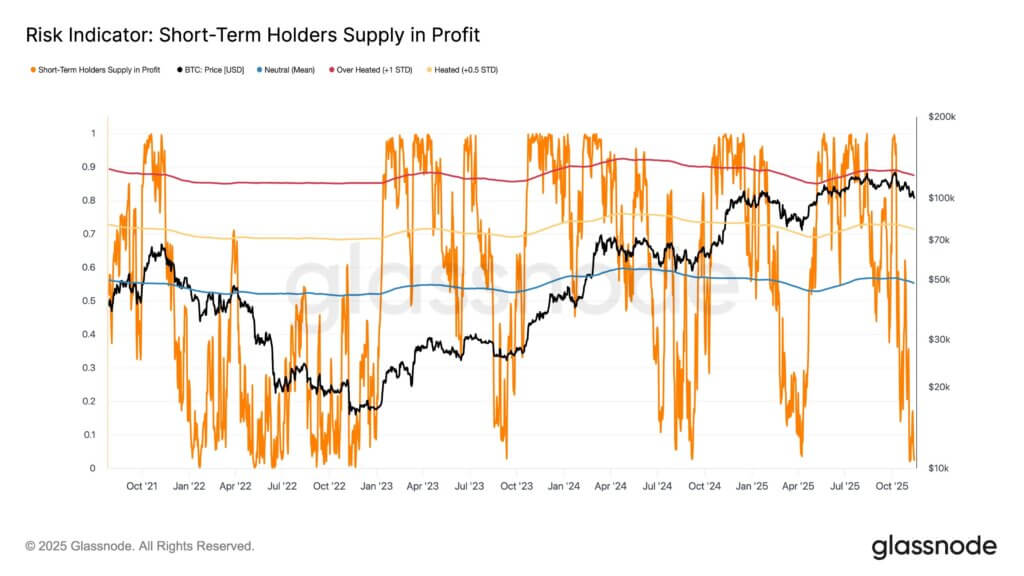

As BTC worth dips under $100,000, Glassnode want to share some miserable statistics. In the event you've been piling up your satellites any time since late spring, it's secure to say your honeymoon is formally on pause.

Bitcoin is buying and selling at $96,000, and a whopping 99% of buyers who purchased it prior to now 155 days have misplaced cash.

BTC worth continues to fall, however narrative is profitable

Promoting strain on the BTC worth for practically two weeks has left merchants and Twitter prognosticators alike looking for indicators of life among the many rubble. Bloomberg host Joe Weisenthal lamented:

“Bitcoin has been declining for 12 consecutive days.''

Bitcoin's infamous correlation with the Nasdaq hasn't helped issues, even when BTC's worth motion has felt extra like a bearish ballet than a “chop.” In the event you ask Wintermute market makers, they level to the expertise slide because the anchor of the digital gold story. Even when these indexes fall, Bitcoin nonetheless stubbornly follows swimsuit.

Nonetheless, in the event you look intently, you'll undoubtedly discover a cause to smile. This week, Bitcoin made a cameo look in a New Yorker cartoon, exhibiting that cultural currencies can high worth charts.

So in the event you purchase the highest, you can even purchase the couscous. As Alex Gladstein of the Human Rights Basis identified in a reply to Weisenthal, BTC costs could also be down, however:

“At the moment’s New Yorker cartoon is about Bitcoin changing fiat foreign money, so we’re advantageous.”

Academic establishments are taking notice (and accumulating extra)

Nonetheless, developments on Wall Avenue inform a extra fascinating story. Bitwise CEO Hunter Horsley revealed that the “financial institution with $1 trillion in belongings beneath administration” invited his group to temporary advisors on Bitcoin, turning what many noticed as a “slowdown” into an acceleration. And he's not alone.

Harvard's ETF Shopping for (Hyperlink Harvard article) reveals that main universities and sovereign wealth funds are sneaking into spot Bitcoin by way of regulated means, with Harvard's Bitcoin IBIT publicity on the high of the listing.

Different monetary establishments are additionally becoming a member of within the parade, undeterred by relentless capital outflows and falling costs. As confirmed in latest filings and crypto market stories, the UAE sovereign wealth fund (Al Warda) has additionally elevated its Bitcoin ETF publicity by 230% since June 2025 and now holds 7.9 million shares price $517 million.

Chopsolidation: What's behind the promoting strain?

In the event you're questioning why the rally is faltering and the bears proceed to feast, on-chain analyst Checkmate breaks it down for you. As a result of the strain on the vendor facet is coming straight from spot Bitcoin holders.

“This has been true all through the cycle thus far. It took some time for individuals to understand it, however the sell-side by present holders is the primary cause for this loopy lengthy interval of inventory consolidation. Folks wish to blame choices and manipulation, however that's simply the HODLers who left.”

One factor is for positive: in a market like this, the story is as a lot an asset because the coin itself. Whereas BTC costs are falling, comedian appearances and institutional briefings function a reminder that volatility and visibility usually go hand in hand. And typically bear markets are simply comedian setup for the subsequent punchline.