In 2025, some firms stuffed the battle chest with various crypto belongings past Bitcoin, resulting in the principle focus of the Digital Financial Treasury reserves. The next highlights the highest 10 public Bitcoin finance firms and the highest 10 Ethereum finance firms.

Prime Bitcoin and Ethereum Finance Corporations

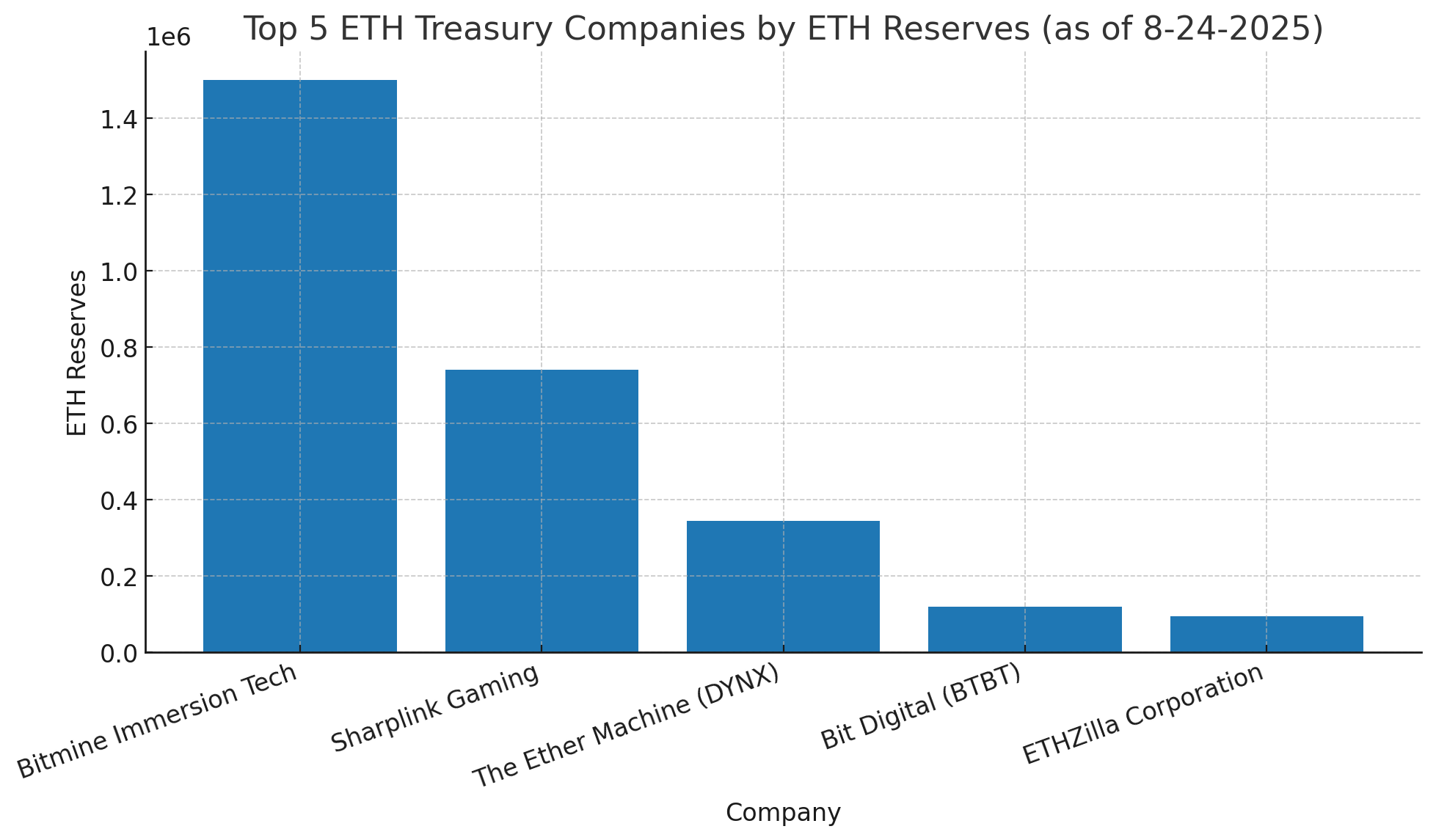

This yr's theme is centered across the institutional adoption of crypto belongings. After the earlier micro-tactic, the technique, it launched a wave of company Bitcoin purchases, and a sequence of inventory buying and selling firms started pursuing lawsuits with Ethereum (ETH) and different various crypto belongings. For instance, as of August 24, 2025, 10 public firms had 2,955,200 ETH, totaling about $14.2 billion.

Public firms are competing to claim management in Ethereum

The rating topping is Bitmine Immersion Tech, which holds a formidable 1.5 million ETH price $72.9 billion. Over the previous six months, the NYSE: BMNR has risen 727%, however previously 5 classes, Bitmine has slipped 12%.

Subsequent is the $3.55 billion Sharplink sport with 740,800 ETH. In 183 days, NASDAQ:SBET received 270%, however SBET exceeded 7% on the final 5 buying and selling days.

In third place is the etheric machine sitting at 345,400 ETH, price $1.65 billion. The corporate, often known as Dynamix Company (NASDAQ: DYNX), has soaked 0.37% over the previous 5 days, however has grown by greater than 10% in six months.

Supply information: StrategeThreserve.xyz

Bit Digital grabs the fourth spot and holds 120,300 ETH, $575 million. BTBT registered with NASDAQ has slipped 4% over the past 183 days, an additional 8.4% lower over the past 5.

Ethzilla Company shouldn’t be fifth, with 94,700 ETH price $453.2 million. NASDAQ-registered Ethzilla Company noticed ticker Ethz rise 148% over six months, whereas five-day statistics present a 51% decline.

Additional down the rankings, BTCS Inc. manages 70,000 ETH, price $335 million, whereas FG Nexus holds 47,300 ETH, price $226 million. GamesQuare Holdings, probably the most well-known of eSports Ventures, owns 15,600 ETH, totaling $74 million.

It was ninth within the ETH technique, with 12,300 ETH price $59 million, and Intchains Group concludes the highest 10 with 8,800 ETH price $42.2 million. In complete, 10 public firms are main 2.45% of the circulation of 120,707,592 ETH.

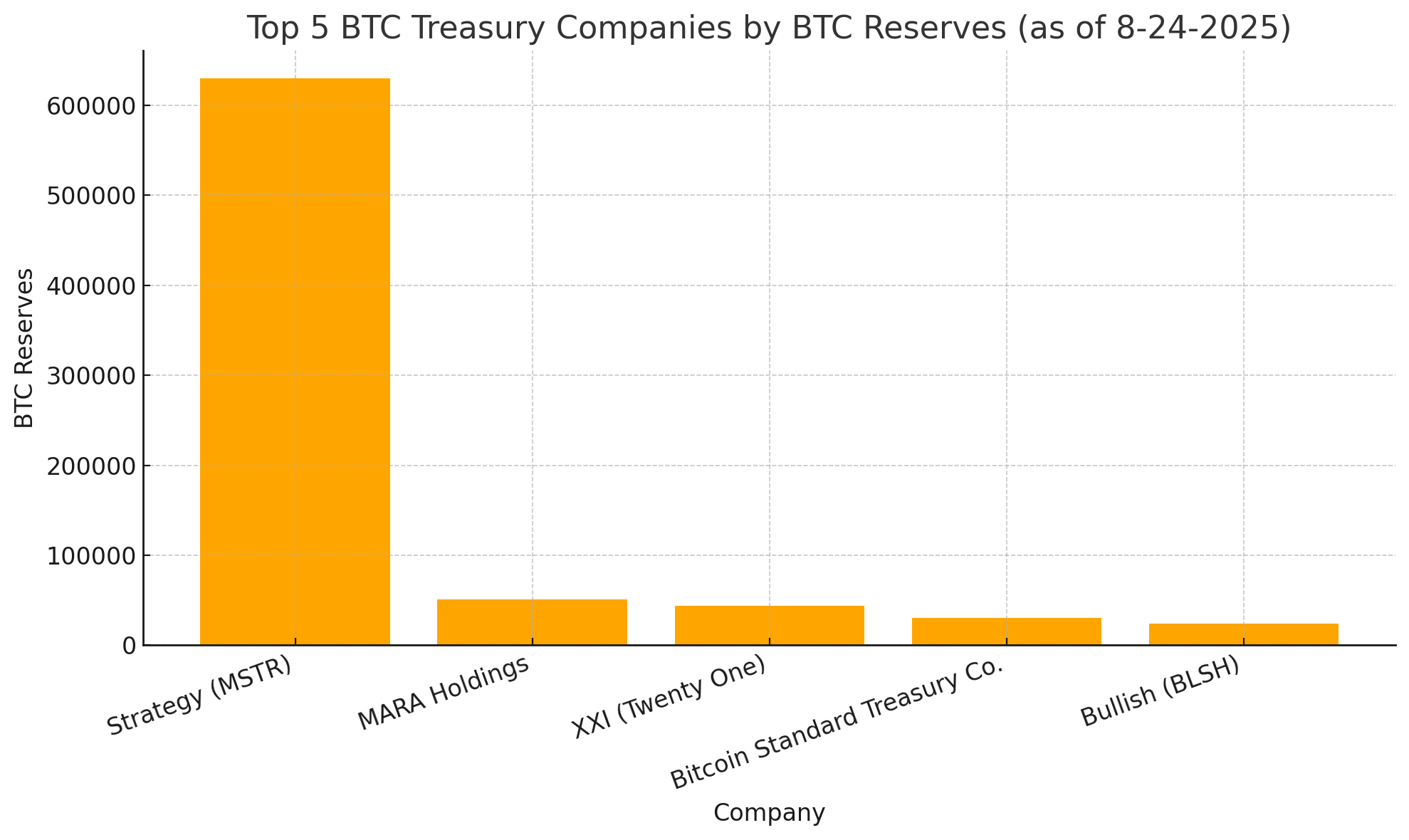

Technique Tower in BTC – Warfare Run All Different Gamers

At Bitcoin (BTC) Enviornment, the technique is the most important company holder, incomes a big margin at 629,376 BTC price $720 billion. The NASDAQ-registered MSTR has scored 9% within the final six months, however skated 3.7% final week.

It's fairly behind, however nonetheless essential, Mara Holdings has 50,639 BTC price $5.79 billion. Shares listed on NASDAQ have grown 0.09% over six months, after a rise of three.8% over the previous 5 days.

XXI is often known as the Twenty One, and is rated third with 43,514 BTC at $4.97 billion. The corporate has not but been revealed and is making ready for its debut following a enterprise mixture with Cantor Fairness Companions.

Supply information: bitcointreasuries.internet

Bitcoin Commonplace Treasury Firm is ranked fourth at 30,021 BTC, price $3.43 billion, and like XXI, it has not but entered the market. By way of a merger with Cantor Fairness Companions I (CEPO), we’re making ready for the Nasdaq checklist.

Newly listed NYSE firm Bullish (BLSH) reported 24,000 BTC, $2.74 billion on its steadiness sheet immediately, up 88% from its debut worth. Nevertheless, BLSH has slid over 6% over the previous week.

In sixth place, Riot Platforms holds 19,239 BTC, whereas Japan's Metaplanet has secured 18,888 BTC. Trump Media & Know-how Group counts 15,000 BTC on the steadiness sheet, whereas CleanSpark closes the highest 10 with 12,703 BTC and Coinbase World at 11,776 BTC.

Total, these 10 firms handle 855,156 BTC. Each ether and bitcoin treasury firms spotlight Crypto's function because the centre of the world's most audacious company gamers.

The statistics collected for this text got here from StrategyEthReserve.xyz and Bitcointreasuries.internet on August 24, 2025.