Lighter has grown quickly, overtaking its main opponents and changing into Ethereum's prime app chain and sixth largest Layer 2 by Complete Worth Locked (TVL).

This speedy rise makes Lighter a real chief amongst decentralized perpetual buying and selling platforms.

Lighter DEX’s spectacular debut and speedy development

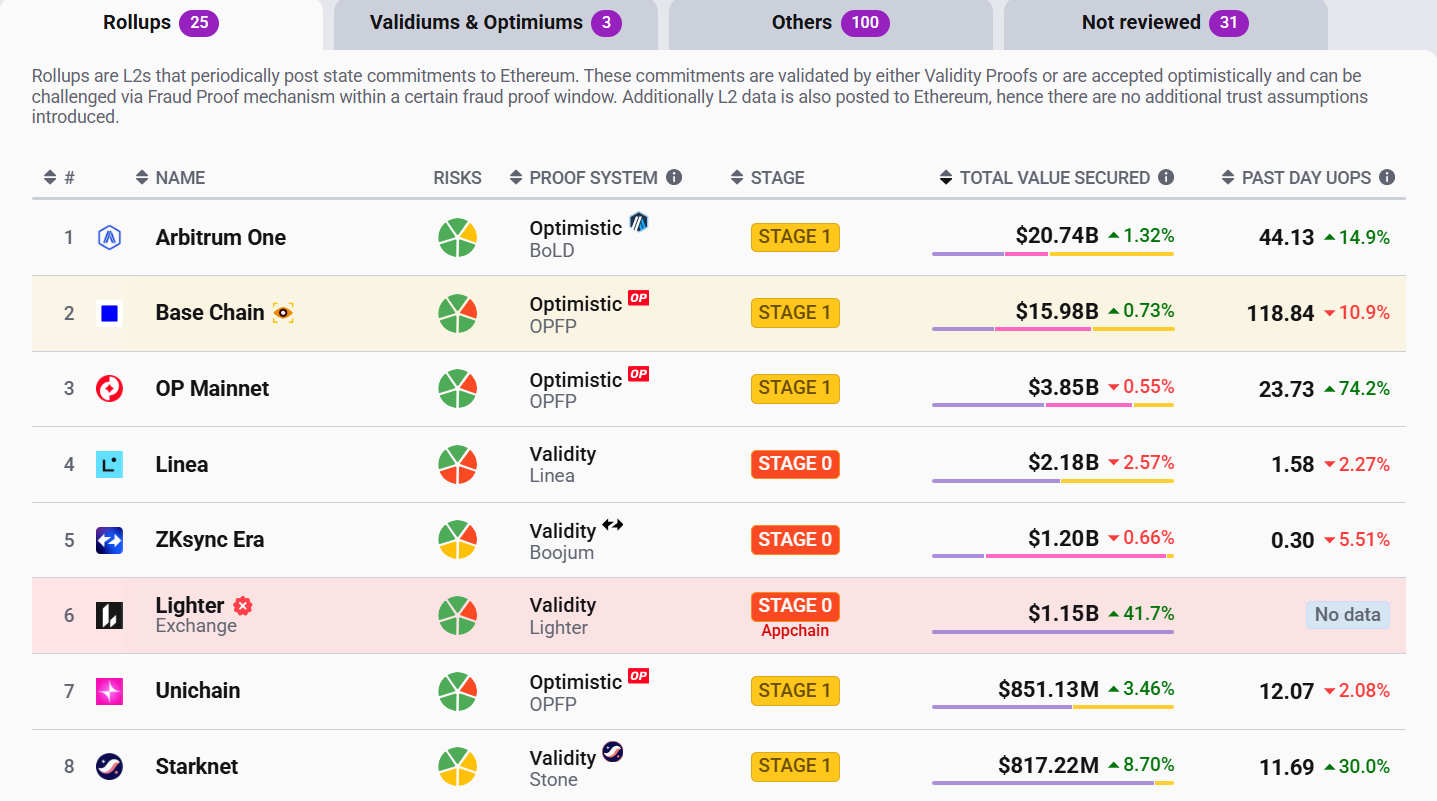

DEX only recently jumped onto the L2Beat leaderboard and have become the sixth largest Layer 2 by TVS. It is usually the main app chain on Ethereum in report time.

Lighter DEX metrics. Supply: L2Beat

The emergence of writers handed as hyperliquid with Ethereum-grade possession has reignited the controversy over whether or not Ethereum can lastly host a really aggressive perpetual DEX (PerpDEX) with out sacrificing safety or scalability.

In keeping with Bankless founder Ryan Adams, Lighter's debut was spectacular. Adams cited the mixture of zero token issuance prices, Ethereum-grade safety, and infinite scalability.

Spectacular debut on L2Beat by @Lighter_xyz.

Lighter is a hyperliquid trade with Ethereum grade possession.

It’s already the sixth largest L2 on TVL and the #1 app chain L2 on Ethereum.

benefit:

– No token issuance value

– Ethereum grade safety

– Infinitely… pic.twitter.com/yVXOjhhS1Y— RYAN SΞAN ADAMS – rsa.eth 🦄 (@RyanSAdams) October 8, 2025

This venture is rising because the standard-bearer for the subsequent era of Ethereum app chains. These encompass customized zk-based rollups that preserve Ethereum's core rules whereas extending efficiency akin to specialised ecosystems like Solana and Cosmos.

“Being L1 is a bug, not a characteristic… L1 is simply Ethereum L2 with none of the safety and verifiability elements,” Adams stated, quoting Reiter founder Vladimir Nowakovsky.

This philosophy resonated with Ethereum maximalists. Many see Reiter as proof {that a} native, high-performing derivatives trade can survive on Ethereum, the final lacking piece in DeFi.

Hovering capital, hovering belief

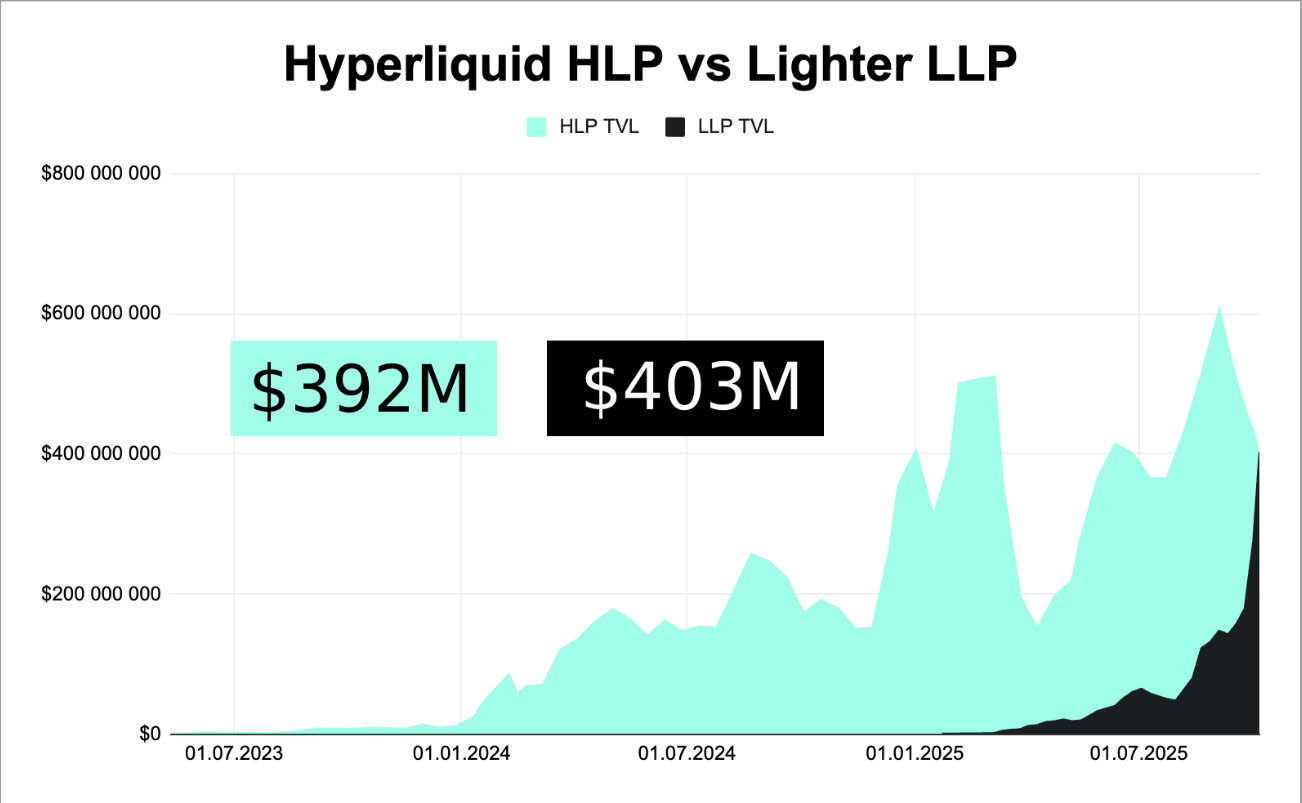

In keeping with knowledge shared by analyst Eugene Brutime, Reiter LLP has overtaken HyperLiquid HLP over the previous week.

“LLP grew by $150 million and exceeded $400 million in TVL,” he stated. “Some hyperliquid LPs are transferring USDC to writers for a easy purpose: yield,” the analyst stated.

Comparability of Hyperliquid LLP and Lighter LLP. Supply: X's Bulltime

In the meantime, Author's yield is 8x that of HyperLiquid (56% vs. 7%), and new deposits are capped at 25% to keep up stability. Even below these limitations, the efficient yield stays twice as excessive.

In keeping with analysts, this pattern is more likely to proceed. He predicts the LLP might attain $600 million to $800 million in a base case.

Such inflows recommend that merchants are reconsidering their allegiances within the PerpDEX area. This can be a uncommon signal that capital is returning to Ethereum after years of fragmentation between layer 1s.

In opposition to this backdrop, there’s a sentiment that Ethereum, regardless of being the birthplace of all DeFi primitives, lacked a great PerpDEX. Whoever solves this downside will turn into one of many greatest gamers in all of Web3.

“Lightweighting is the closest we are able to get to attaining this,” Eugene declared.

Earlier opponents equivalent to dYdX and Synthetix have struggled with scalability and governance points, resulting in their migration away from Ethereum.

Nonetheless, Lighter claims to have cracked the code utilizing a customized zk circuit and a brand new knowledge view format. This permits it to function as a local zk L2 with direct interoperability with Ethereum.

Safety and transparency questions

In keeping with an L2Beat overview, Lighter employs ZK proofs that forestall validators from approving invalid withdrawals. Customers may also pressure transactions via Ethereum L1, making certain censorship resistance, an essential improve for decentralized exchanges.

Nonetheless, L2Beat researcher Donnoh on X warned that the venture's zk program is just not but open supply and its Oracle certification nonetheless must be strengthened. The staff guarantees to handle each in future updates.

I simply completed reviewing the venture, so right here's a brief thread about @Lighter_xyz 🧵 https://t.co/NmlA8jGMVi pic.twitter.com/9yHwt4sLqm

— donnoh.eth 💗 (@donnoh_eth) October 8, 2025

In the meantime, the explosive entry of writers displays a broader sample seen with Ripple's RLUSD, with Ethereum capturing many of the development moderately than the unique community.

In the identical manner that RLUSD’s $789 million market cap highlighted Ethereum’s gravitational pull in direction of stablecoins, Leiter’s momentum might replicate DeFi’s dominance as the last word cost layer.

If early alerts are right, lighters might turn into extra than simply hyperliquid. That is Ethereum’s long-awaited reply to the PerpDEX downside, and it might be the venture that turns the app chain into the ecosystem’s subsequent defining story.

The publish Why Writers Can Reply Ethereum's PerpDEX Issues first appeared on BeInCrypto.